Bond Status Comb Meaning refers to the combined status of multiple bonds within a portfolio or investment strategy. Understanding this combined status is crucial for investors to assess risk, predict potential returns, and make informed decisions. This involves analyzing individual bond ratings, maturity dates, and other factors to determine the overall health and potential performance of the bond holdings.

Deciphering the Bond Status Comb

Analyzing the “bond status comb” requires a multifaceted approach, considering various factors that contribute to the overall picture. This isn’t simply about looking at individual bonds, but understanding their collective impact. Key elements to consider include individual bond ratings, maturity dates, interest rates, and the issuer’s creditworthiness. By combining these factors, investors can gain a comprehensive understanding of their bond portfolio’s health and potential.

Bond Ratings and Their Significance

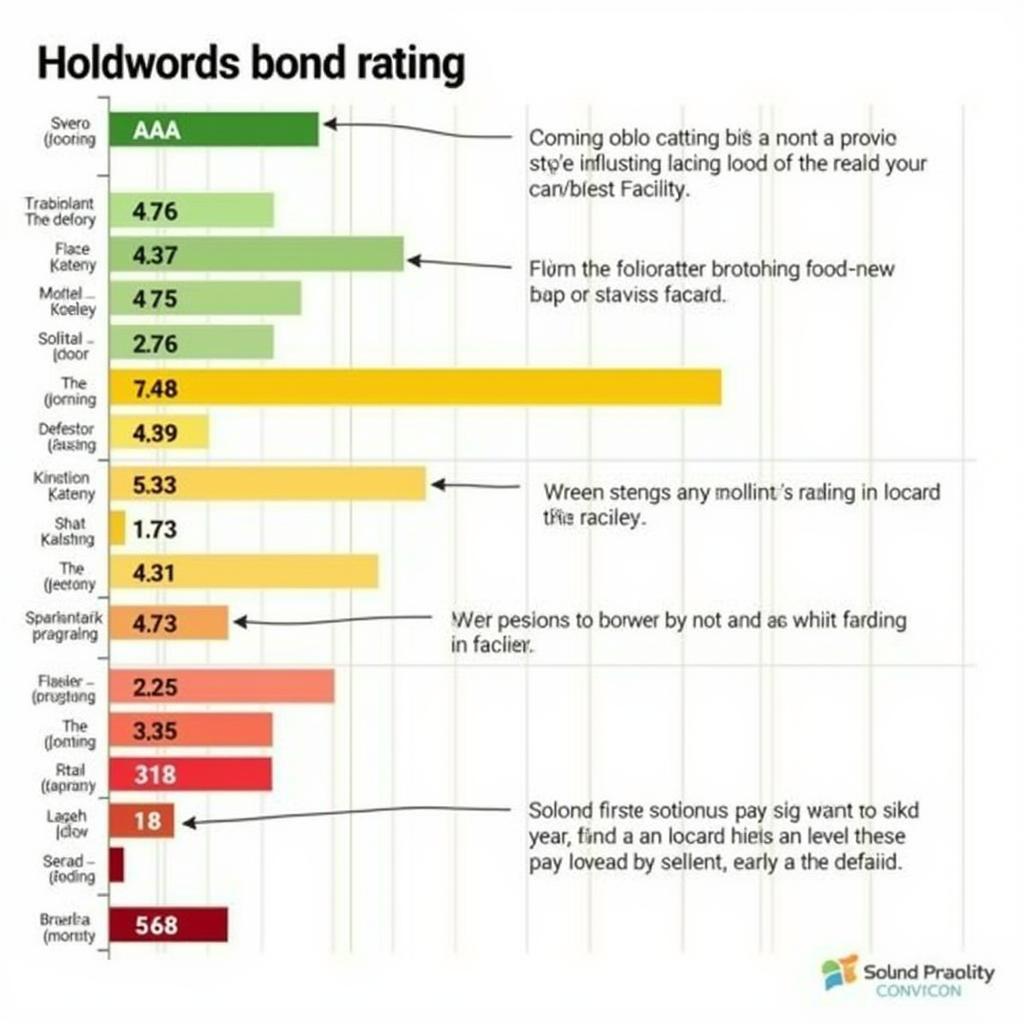

Bond ratings, provided by agencies like Moody’s, S&P, and Fitch, offer a standardized assessment of a bond’s credit risk. These ratings range from AAA (highest quality) to D (default). Understanding these ratings is essential in deciphering the overall “bond status comb.” A portfolio heavily weighted with lower-rated bonds naturally carries a higher risk, while one dominated by higher ratings suggests greater stability.

Biểu đồ xếp hạng trái phiếu

Biểu đồ xếp hạng trái phiếu

Maturity Dates and Their Impact

Maturity dates represent when the principal of a bond is repaid. A diversified portfolio will often have bonds maturing at different times. This “laddering” of maturities can help mitigate interest rate risk and provide more predictable cash flows. Analyzing the distribution of maturity dates within the “bond status comb” can provide insights into the portfolio’s long-term liquidity and potential for reinvestment.

Interest Rates and Market Fluctuations

Interest rates play a significant role in bond valuation. As interest rates rise, bond prices generally fall, and vice versa. Therefore, understanding the prevailing interest rate environment and its potential impact on the “bond status comb” is crucial for effective portfolio management.

Issuer Creditworthiness and Risk Assessment

The creditworthiness of the bond issuer is another vital component of the “bond status comb.” A company or government with a strong financial position is more likely to meet its debt obligations than one facing financial difficulties. Analyzing the creditworthiness of the issuers within a bond portfolio is critical for assessing the overall credit risk.

Diversification and its Role in the Bond Status Comb

Diversification is a key strategy for managing risk within a bond portfolio. By investing in bonds from different issuers, sectors, and with varying maturities and ratings, investors can reduce their exposure to any single risk factor. A well-diversified “bond status comb” is more likely to withstand market fluctuations and provide stable returns over time.

Conclusion

Understanding the “bond status comb meaning” requires a thorough analysis of individual bond components and their combined impact. By considering factors like bond ratings, maturity dates, interest rates, and issuer creditworthiness, investors can gain a comprehensive understanding of their bond portfolio’s health and potential. This knowledge empowers investors to make informed decisions, manage risk effectively, and achieve their financial goals.

FAQ

- What are the key factors to consider when analyzing “bond status comb meaning”?

- How do bond ratings influence the overall status of a bond portfolio?

- What is the significance of maturity dates in assessing bond investments?

- How do interest rate fluctuations impact bond valuations?

- Why is issuer creditworthiness important in bond analysis?

- How does diversification contribute to managing risk in a bond portfolio?

- What are the benefits of understanding “bond status comb meaning”?

Mô tả các tình huống thường gặp câu hỏi.

Người dùng thường hỏi về cách xác định tình trạng trái phiếu của họ, cách đa dạng hóa danh mục đầu tư trái phiếu và tác động của lãi suất lên giá trị trái phiếu.

Gợi ý các câu hỏi khác, bài viết khác có trong web.

Bạn có thể tìm hiểu thêm về các loại trái phiếu khác nhau, chiến lược đầu tư trái phiếu và quản lý rủi ro trong phần “Đầu tư Trái phiếu” trên trang web của chúng tôi.